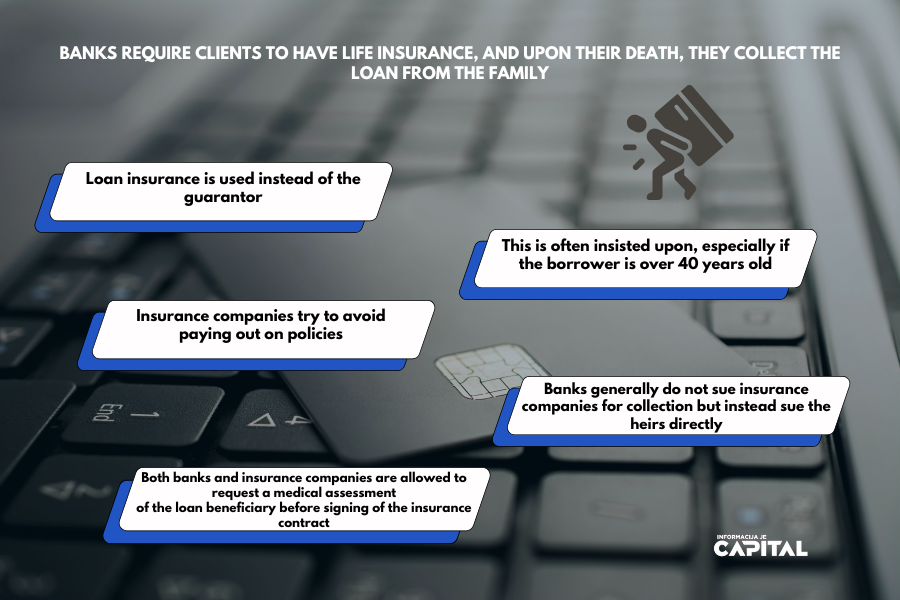

Banks require clients to have life insurance, and upon their death, they collect the loan from the family

Some insurance companies and banks have established the practice of marketing loans with life insurance in case of the death of the borrower, but without any real intention to fulfill their obligations when it actually happens, claim the sources of portal CAPITAL.

According to our sources, who substantiate their claims with court rulings and lawsuits, if the loan beneficiary dies before paying the last installment, banks and insurance companies vigorously pursue the collection of claims from the heirs instead of settling from the insurance policy that the beneficiary had to accept and pay in order to secure the loan in the first place.

They claim that loan insurance has become a powerful tool for selling insurance products, often owned by banks themselves, from which they profit significantly, while borrowers receive little benefit.

According to our sources, banks ceased requiring guarantors several years ago, introducing instead the practice of life insurance for loans, particularly for individuals over 40, along with the salary and mortgage. This shift was prompted by the difficulty in finding guarantors and salaries of many citizens are already heavily burdened.

“Numerous banks have contracts for business and technical cooperation with insurance companies, and some of these insurance companies are even owned by banks. They aggressively promote their products such as life insurance for loans, often without a genuine intention to provide coverage if something happens to the borrower. Additionally, borrowers are compelled to accept the insurance company imposed by the bank and are charged fees ranging from several hundred to several thousand marks, despite their supposed right to choose their insurance provider”, said our interlocutor.

Banks and insurance companies in joint business

If a death occurs, said our interlocutor, insurance companies seek ways and reasons to avoid payment, while banks accept their reasoning and promptly turn to the heirs, suing them and demanding repayment.

“It is evident that there exists an agreement recognized by the courts, which consistently rule in favor of the heirs. However, often unaware of this, heirs become involved in lawsuits, and some even settle with the bank just to avoid court proceedings”, said our interlocutor.

His claims are supported by the ruling of the District Court in Banja Luka, which dismissed a claim filed by UniCredit Bank Banja Luka on two occasions to collect 5.000 marks from the heirs. The bank was obligated to seek payment from Croatia Osiguranje, which issued the loan insurance policy. The court determined that since there was life insurance in place, the heirs bore no liability.

According to the ruling reviewed by CAPITAL, the loan was finalized on December 24, 2015, amounting to 7.000 marks with a repayment period of 60 months. To secure the loan, the borrower had to take out a policy covering death and illness resulting from an accident, among other requirements.

the outstanding loan debt three years later, on the day of the borrower’s death, was BAM 5.008. In addition to this amount, the bank also demanded statutory default interest totaling BAM 2.038 on the principal amount, along with additional statutory default interest amounting to BAM 4.871 until the date of payment. Furthermore, the bank requested reimbursement of procedural costs totaling 600 marks. These additional charges significantly exceeded the original loan amount that the borrower owed when the loan was issued, and had to be paid by the insurance company.

“With their signatures, both the bank and the loan beneficiary confirmed their agreement for the client to be insured by Croatia Osiguranje. In the event of the beneficiary's death, the insurance company was supposed to pay the bank the remaining principal amount as well as the accrued interest on the day the insured event occurred. However, the insurance company claimed that the client had been undergoing treatment for mental disorders for years, arguing that they were not obligated to pay under these circumstances. The first-instance court viewed this claim as a blanket assessment, stating that the insurer could have assessed the relevant health conditions of the insured at the time of contract conclusion”, reads the ruling.

Heirs often remain unaware that they are not obligated to settle the debt

The court’s ruling clarifies that heirs are not responsible for the deceased’s debts if there was life insurance in place. In situations where the loan beneficiary secures loan repayment during their lifetime, as in this case, their rights and obligations from the loan agreement do not transfer to their heirs.

“Based on this understanding, the debt stemming from the loan should be covered by the insurance company, specifically Croatia Osiguranje. The insurance company, having a technical cooperation agreement with the bank, had the opportunity to assess the insured’s health condition, as clearly and decisively explained by the first-instance court”, decided the District Court Banjaluka.

Attorney Din Tešić asserts that he has handled several lawsuits where banks explicitly compelled loan beneficiaries to pay for insurance. However, when death occurred due to unforeseen circumstances, the banks promptly pursued the heirs to recover the entire loan amount, rather than limiting their claim to the inherited portion as stipulated by law, which is illegal.

He asserts that insurance companies frequently fabricate trivial reasons to deny claims, such as citing the deceased’s smoking habits, unhealthy diet, or alcohol consumption. These reasons are often brought up after the insurance policy and loan have been finalized. The insurance companies overlook the fact that, before entering into the contract, they could have collaborated with medical professionals to verify these factors they later use as grounds for denial.

“Insurance companies and banks collaborate to offer loan insurance in the event of the loan beneficiary’s death, but often without genuine intentions to fulfill their obligations by paying off the remaining loan amounts after the person’s death. They unreasonably reject claims to the bank, citing nonsensical reasons. For instance, that the loan beneficiary knew that they were seriously ill or that he endangered their life with habits they had. In one of the cases I had the insurance company claimed that the borrower caused their own heart attack by consuming alcohol, even though alcohol consumption typically leads to liver disease, not cardiac arrest”, explained Tešić.

They focus on insignificant details

He further explains that insurance companies often cite irrelevant reasons to deny policy payouts, thereby avoiding their contractual obligation to pay off the loan to the bank. He alleges that banks collaborate with insurance companies, formally requesting insurance policies, and when claims are denied, they fail to sue the insurance companies as required by law. Instead, they pursue legal action against the heirs.

“The situation worsens when heirs are asked to pay the entire debt instead of just up to the amount of the inherited portion. My office has repeatedly requested both Raiffeisen Bank and Uniqa Insurance to provide their contracts for business and technical cooperation for review. This is to determine whether the bank has an interest in the insurance company failing to fulfill its obligations. Finally, the court ordered Raiffeisen Bank to submit their business and technical cooperation contract”, said Tešić.

He explains that according to the law, the bank is required to sue the insurance company first. Only if the insurance company proves that it is not obligated to pay the loan should the bank then pursue legal action against the heirs. However, this didn’t happen.

“This is a biased lawsuit. It is no coincidence; it is evident that it exists and is a phenomenon”, said Tešić.

He explains that according to the law, the bank is required to sue the insurance company first. Only if the insurance company proves that it is not obligated to pay the loan should the bank then pursue legal action against the heirs. However, this didn’t happen.

“This is a biased lawsuit. It is no coincidence; it is evident that it exists and is a phenomenon”, said Tešić.

And this is not an isolated incident.

Recently, Uniqa Insurance asked the heirs of J. N. to settle the remaining balance of the deceased’s loan, totaling over 17.000 marks. The deceased had taken out a 25.000 mark loan with UniCredit Bank and had life insurance. However, this insurance company refused to cover the policy after the beneficiary’s death, citing that the deceased knew or should have known about her illness.

“The insurance contract is void if, at the time of its conclusion, the insured event had already occurred, was in progress, or was certain to occur. According to the findings and opinion of the acting physician, as well as our assessment, the diseases that the beneficiary had significantly affected her life expectancy and could lead to serious and permanent illnesses”, read the response from Uniqa Insurance. They argue that the loan beneficiary must have been aware of the possibility of illness, even though their doctor did not detect or diagnose this from the medical records at the time the policy was taken out.

This case also went before the court.

The Office of the RS Insurance Ombudsman emphasizes that the law provides for extrajudicial resolution of disputes and disagreements concerning insurance contracts.

“Citizens (heirs) did not approach the insurance ombudsman due to insurance companies’ refusals to settle loans for which the beneficiaries, now inherited, held life insurance policies and passed away before the loan was fully repaid. Instead, citizens filed complaints regarding cash loan repayment insurance, specifically concerning the return of the unused portion of premiums in cases of early loan repayment. In 2023, there were 10 such complaints, with an additional five in the first half of 2024”, said this office.

We reached out to both banks and insurance companies twice. Initially with questions and subsequently to remind them of our expectation for responses. Aside from UniCredit Bank, none of the subjects provided answers.

UniCredit Bank requested details about whom we had sent the inquiry to and set conditions for responding. Despite our reiterated deadlines, they did not provide a response thereafter.